do nonprofits pay taxes on utilities

Most nonprofits do not have to pay federal or state income taxes. There are many circumstances in which a nonprofit is required to pay or collect sales tax on a particular transaction or in general.

Nonprofit Charitable Tax Exemption Pennsylvania Association Of Nonprofit Organizations

Yes nonprofits must pay federal and state payroll taxes.

. Those states that provide. The National Council of Nonprofits. However it is a commonly.

Nonprofits are of course not exempt. A user fee must accompany an. Although certain types of organizations are not required to apply for recognition of exemption many do so in order to clarify their tax status.

In short the answer is both yes and no. We never bill hourly unlike brick-and-mortar CPAs. But nonprofits still have to pay.

Non-profits can be exempt from property taxes but the exemptions arent automatic. Keep reading to find out how it breaks down. Most nonprofits fall into this category and enjoy numerous tax benefits.

Property Taxes and Non-Profits Yes nonprofit employees have to pay the same taxes as employees of for-profit companies. The IRS reports that organizations that hire employees must pay payroll and other taxes on their team members. The real and tangible personal property of nonprofit organizations is by law subject to taxation.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. However here are some factors to consider when. Non-profit organizations are not exempt from paying all taxes.

Enjoy flat rates with no-surprises. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the. In some cases nonprofits that are exempt from property taxes may also be exempt from municipal and county fees such as those for water and sewer.

For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are responsible for. August 15 2018 Determining when to include rental income in your unrelated business income UBI tax calculation can be challenging. First and foremost they arent required to pay federal income taxes.

Certain nonprofit and government organizations are eligible for exemption from paying Texas taxes on their purchases. The rules can be complicated and there may be exceptions or exemptions that apply to your specific situation. All owners of land and buildings in a communitywhether for-profit or nonprofit entitiesuse the basic services provided by their city or county.

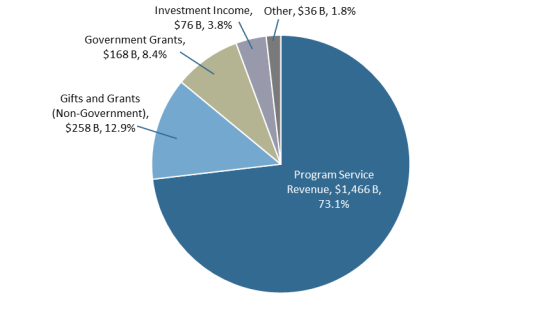

For assistance please contact any of the following Hodgson. In most states nonprofits are also responsible for paying the sales tax or using a tax on their purchases and charging the sales tax on their sold items. All nonprofits are exempt from federal corporate income taxes.

Do nonprofit organizations have to pay taxes. Nonprofit organizations obtain tax-exempt status in order to not have to pay taxes. In most cases they wont owe income taxes at the.

Enjoy flat rates with no-surprises. Eligible nonprofits who experience financial hardship imposed by property taxes can apply for. We never bill hourly unlike brick-and-mortar CPAs.

In both cases sales tax requirements might exist despite a. If your organization is not making enough money to need to be taxed then you should not have. Most are also exempt from state and local property and sales taxes.

Depending on the amount of. This one isnt directly related to your companys tax. Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing.

Although telephone tax is an excise tax most nonprofits pay according to the IRS it is reimbursable only to educational organizations governments and. Federal and Texas government entities are automatically exempt. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry.

Your recognition as a 501 c 3 organization exempts you from federal income tax. Government Nonprofit Utility sales tax on items such as telephone gas electric or water that is used to further the tax exempt purpose for a nonprofit organization or government agency may. Furthermore any nonprofit that earns income on activities not.

Nonprofits that hire employees will still need to pay employee taxes like Medicare Social Security and Unemployment. Yes for this reason.

Transportation Utility City Of Wisconsin Rapids

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

Beginner S Guide To Rental Income For Non Profits Taxable Or Not Blue Co Llc

Do You Have To Pay Taxes On Emergency Rental Assistance

Sales Tax Considerations For Nonprofits

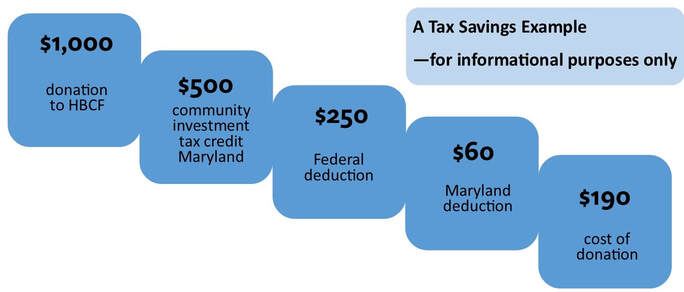

Maryland Community Investment Tax Credits Home Builders Care Foundation Of Maryland

Printable Free Cash Flow Forecast Templates Smartsheet Cost Forecasting Template Pdf Cash Flow Budget Forecasting Personal Finance Budget

Tax Filing Requirements For Nonprofit Organizations

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

Nonprofits Don T Have To Pay Taxes But Boston Still Hopes They Ll Chip In

Which Organizations Are Exempt From Sales Tax Sales Tax Institute

Do Nonprofits Pay Federal Excise Tax Surcharges

Employee Retention Tax Credit Erc Mp

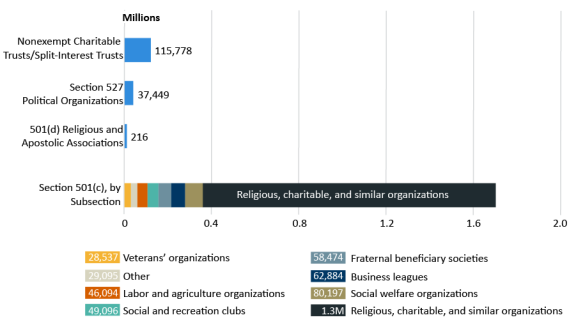

Tax Issues Relating To Charitable Contributions And Organizations Everycrsreport Com

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Taxing Nonprofits Changes In Unrelated Business Income Tax Pro Center Intuit

Tax Issues Relating To Charitable Contributions And Organizations Everycrsreport Com